Bitcoin's Back, Baby! How Crypto's Stabilization Phase Sets the Stage for a Massive 2026

Okay, folks, buckle up! I'm seeing something truly amazing happening in the crypto world right now, and I can barely contain my excitement. We've been through the wringer, haven't we? A wild ride of peaks and valleys that could make even the most seasoned investor queasy. But what if I told you that the rollercoaster is finally leveling out, and we're about to enter a period of unprecedented stability and growth? That's right, I'm talking about a crypto renaissance!

The Calm After the Storm: Stabilization is Here

The headlines might still be screaming about market corrections and potential pitfalls, but I'm looking deeper. I'm seeing the signs of a market that's finally maturing, shedding its excessive debt, and shaking off those nervous short-term holders. Think of it like a forest fire – devastating in the moment, but ultimately clearing the way for new growth, stronger and more resilient than before. Analysts at Bitfinex are even saying that we're seeing "seller exhaustion" and "capitulation of short-term holders." In other words, the weak hands are out, and the serious players are here to stay.

The Old Guard Embraces Bitcoin

And get this: even traditionally conservative bond funds are now dipping their toes into Bitcoin ETFs as diversification tools! Texas, bless their hearts, became the first US state to publicly invest in Bitcoin. It's a symbolic move, sure, but symbols matter! It shows that the tide is turning, that even the old guard is starting to recognize the potential of this revolutionary technology. It's like watching your grandpa finally figure out how to use a smartphone – a little late to the party, maybe, but still a sign that the world is changing.

Navigating the Remaining Hurdles

Of course, there are still hurdles to overcome. The article mentions concerns about MSCI potentially excluding major crypto-holding companies, which could trigger forced sell-offs and weaken market liquidity. But here's the thing: even in the face of these challenges, the underlying fundamentals of Bitcoin and other cryptocurrencies remain incredibly strong. I'm reminded of the early days of the internet when everyone was worried about bandwidth limitations and security threats. Did those concerns stop the internet from transforming the world? Absolutely not! And I believe the same will be true for crypto.

The Institutional Stampede: Bitcoin Goes Mainstream

What's really got my attention is the increasing institutional interest in Bitcoin. BlackRock, the undisputed king of asset management, has been steadily increasing its IBIT fund's strategic portfolio, acquiring a staggering 2.39 million shares. ARK Invest, known for its bold bets on disruptive technologies, continues to invest heavily in crypto companies. This isn't just a passing fad, folks; this is a full-blown institutional stampede! It reminds me of the California Gold Rush, except instead of panning for gold, these institutions are scooping up Bitcoin, the digital gold of the 21st century.

Global Adoption: Japan's Crypto-Friendly Policies

And speaking of gold, let's talk about Japan. They're moving towards a flat 20% tax on cryptocurrency gains, a move that could attract a flood of liquidity back to domestic exchanges and boost overall tax receipts. This is huge! It's like putting a welcome mat out for crypto investors, signaling that Japan is open for business and ready to embrace the future of finance.

The Future of Bitcoin: Maintaining Decentralization

But here's the question that keeps me up at night: are we ready for this level of institutional adoption? As Bitcoin becomes more mainstream, will it lose its rebellious, decentralized spirit? Will it become just another tool for the financial elite to consolidate power? These are important questions that we need to grapple with as we move forward. We need to ensure that Bitcoin remains a force for good, a technology that empowers individuals and promotes financial inclusion.

Conclusion: Bitcoin's Resilience Paves the Way

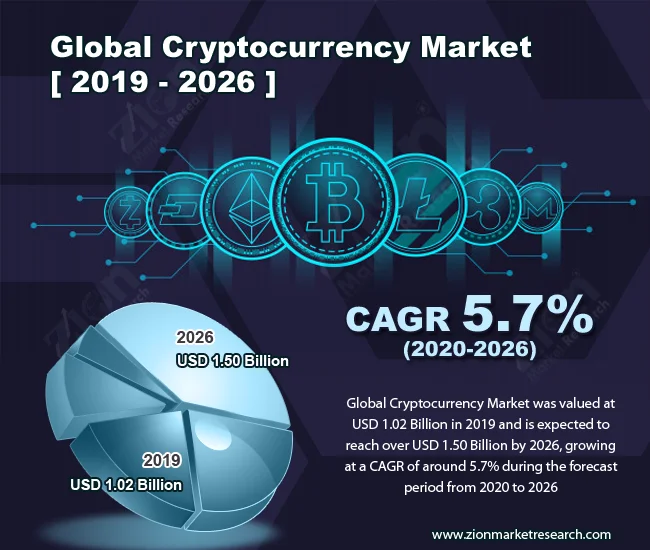

So, what's the bottom line? The cryptocurrency market is entering a stabilization phase, driven by reduced debt, seller exhaustion, and increasing institutional adoption. Crypto Market Enters a Stabilisation Phase, Experts Say While challenges remain, the underlying fundamentals of Bitcoin and other cryptocurrencies are incredibly strong. This is not just a temporary bounce; it's a sign that the crypto market is maturing and preparing for its next phase of growth.

Crypto's Ready for Liftoff!

This is the kind of breakthrough that reminds me why I got into this field in the first place. And what this all means is that it is time to strap in, because the next chapter of the crypto story is about to be written, and it's going to be epic!