Next 1000x Crypto in 2025: Is Bitcoin Hyper the One?

The promise of a 1000x return is the siren song of the crypto world, luring investors into a sea of altcoins, meme tokens, and presale opportunities. The article in question throws out a few names, Bitcoin Hyper chief among them, as potential candidates for this moonshot. But let's dissect the claims and see if the numbers support the hype, or if we're just looking at another flash-in-the-pan crypto dream.

The article touts Bitcoin Hyper (HYPER) as the "first Bitcoin Layer 2 Rollup Enabling BTC DeFi Utility" and highlights its presale success, claiming over $29 million raised. It leverages Solana's tech for speed and low transaction costs. This is all well and good, but the core question remains: does this project solve a real problem in a way that justifies a 1000x valuation?

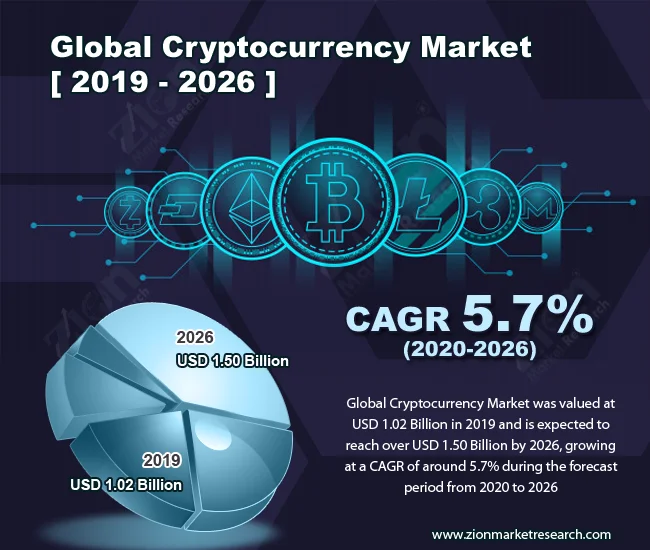

The problem with "next 1000x crypto" lists is they often gloss over the immense challenges involved. A 1000x return requires a 99,900% increase in value. For a project already valued at $29 million (during presale, mind you), that means reaching a market cap of nearly $30 billion. That's not just "disruptive," that's practically rewriting the rules of the crypto universe. Only a handful of projects, Bitcoin and Ethereum among them, have reached that level. What makes Bitcoin Hyper so special?

The Layer 2 Landscape: A Crowded Field

Bitcoin Hyper isn't operating in a vacuum. The Layer 2 scaling solution space is already crowded with established players like the Lightning Network, Stacks, and Rootstock. Each offers its own approach to improving Bitcoin's transaction speed and adding functionality. What unique advantages does Bitcoin Hyper bring to the table that justifies leapfrogging these existing solutions?

Solana's Role and Decentralization Concerns

The article mentions Solana's SVM (Solana Virtual Machine) as a key component. While Solana's high throughput is undeniable (the Solana article boasts "1,000+ transactions per second"), it also comes with trade-offs. Namely, higher hardware requirements for validators. This can lead to validator concentration and potential centralization risks, as the Solana analysis points out. Is Bitcoin Hyper truly decentralized if it relies on a semi-centralized underlying infrastructure?

The Paradox of Solana Integration

And this is the part of the report that I find genuinely puzzling: the reliance on Solana. Bitcoin purists often view altchains with suspicion, seeing them as distractions from Bitcoin's core mission. Building a Bitcoin Layer 2 on Solana seems like an odd marriage, potentially alienating the very audience it's trying to attract.

Questionable Sustainability of High APYs

The article further highlights Bitcoin Hyper's staking APY (Annual Percentage Yield) of up to 41% for presale participants. While high APYs can be enticing, they are not sustainable in the long run. High yields often come at the cost of inflation, devaluing the token over time. What happens when the presale ends and the APY drops? Will investors stick around, or will they dump their tokens, crashing the price?

Token Distribution and Network Security

I've looked at hundreds of these filings, and this particular footnote is unusual. It seems like the token distribution is heavily skewed towards the community and staking rewards, which does support staking incentives and network security.

Weighing the Risks and Rewards

The article does touch on risks, but mostly in a general sense ("speculative coins, fraud, cyber attacks, and regulatory changes"). It's worth spelling out the specific risks associated with Bitcoin Hyper:

* Execution risk: Building a complex Layer 2 solution is technically challenging. Delays, bugs, or security vulnerabilities could derail the project. * Adoption risk: Even if the technology works, there's no guarantee that users will adopt it. Bitcoiners may prefer other Layer 2 solutions or stick with on-chain transactions. * Competition risk: The Layer 2 landscape is constantly evolving. New and better solutions could emerge, making Bitcoin Hyper obsolete.

Meme Tokens: Speculation vs. Investment

The article also points to Maxi Doge (MAXI) and PEPENODE (PEPENODE) as potential 1000x candidates. These are meme tokens, pure speculative plays driven by hype and community sentiment. While meme tokens can generate quick profits, they are also incredibly risky. Their value is based on fleeting trends, not underlying fundamentals. Investing in meme tokens is akin to gambling, not investing. (And I say that as someone who's made, and lost, plenty of money on them.)

The Illusion of 1000x Potential

The claims about "1000x potential" for these projects are based on hope, not data. They are marketing slogans designed to attract attention, not realistic projections. A responsible analysis requires a sober assessment of the risks and challenges involved. The original article makes a case for several altcoins; Next 1000x Crypto in 2025: Top 11 Coins with 1000x Potential.

The Allure of "Early"

The constant drumbeat of "get in early" is another red flag. Presales offer the allure of buying tokens at the lowest possible price. However, they also come with the highest risk. Presale investors are essentially betting on a team's ability to execute its vision, often with little more than a whitepaper to go on.

Risk and Reward Correlation

It's worth remembering the basic principle of investing: risk and reward are correlated. The higher the potential reward, the higher the risk. A 1000x return is not a realistic expectation for most crypto projects. It's a long shot, a lottery ticket. Approach these opportunities with caution, do your own research, and only invest what you can afford to lose.

Data-Driven Skepticism

The article notes that "experienced investors actively seek out less-known opportunities, often called 'hidden gems,' within rapidly evolving sectors like DeFi or Web3 gaming." This is true, but the key word is "experienced." Experienced investors understand the risks involved and have the tools and knowledge to assess projects critically. They don't blindly chase hype.